Pepe

, the world’s third-largest stablecoin by market value, has failed to keep gains above the 100-day simple moving average (SMA) amid continued distribution or selling by holders.

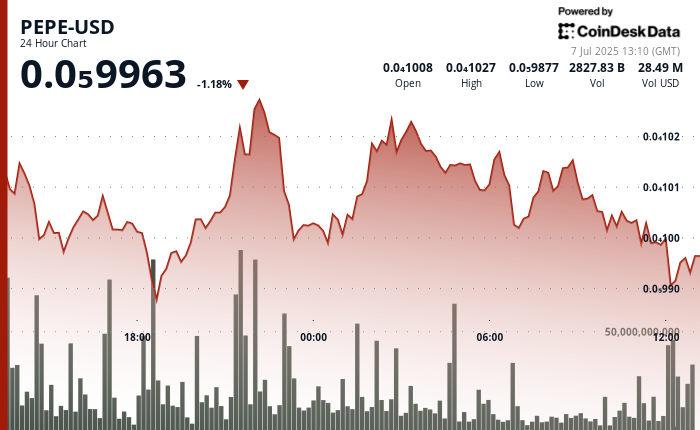

The cryptocurrency briefly topped the 100-day SMA at $0.00001009 early Monday before reversing the spike to trade 1% lower at $0.00000992 as of writing, according to CoinDesk data.

Volume patterns suggest distribution rather than accumulation, with four distinct high-volume selling periods creating a descending resistance trendline. This follows significant transfers of coins to exchanges, hinting at potential liquidation by large traders. Recently, whale transfers included the movement of 500 billion PEPE, worth $3.85 million, to Binance, highlighting ongoing volatility in the meme token space, according to CoinDesk’s AI insights.

Broadly speaking, the token remains locked in a sideways range identified by trendlines connecting June 25 and July 3 highs and lows registered on June 22 and July 2. A breakdown of the channel would imply a continuation of the downtrend from May 23 highs.

Key AI insights

Technical indicators for PEPE remain mixed, with RSI at 44.29 and sentiment classified as neutral.The token’s price action during recent hours showed a sharp sell-off with exceptionally high volume, creating a descending resistance trendline.Despite these challenges, analysts project significant long-term potential, with some forecasts suggesting PEPE could reach $0.000035 by 2025 and potentially $0.0258 by 2030.PEPE coin maintains critical support at $0.00000099 despite profit-taking, forming a consolidation pattern between $0.0000099 and $0.0000102.Memecoin sector shows rotation with Bonk surging 6-7% on ETF buzz while Dogwifhat drops 4-10%, testing key support amid declining volume.